The Forgotten Step in Developing Your Message

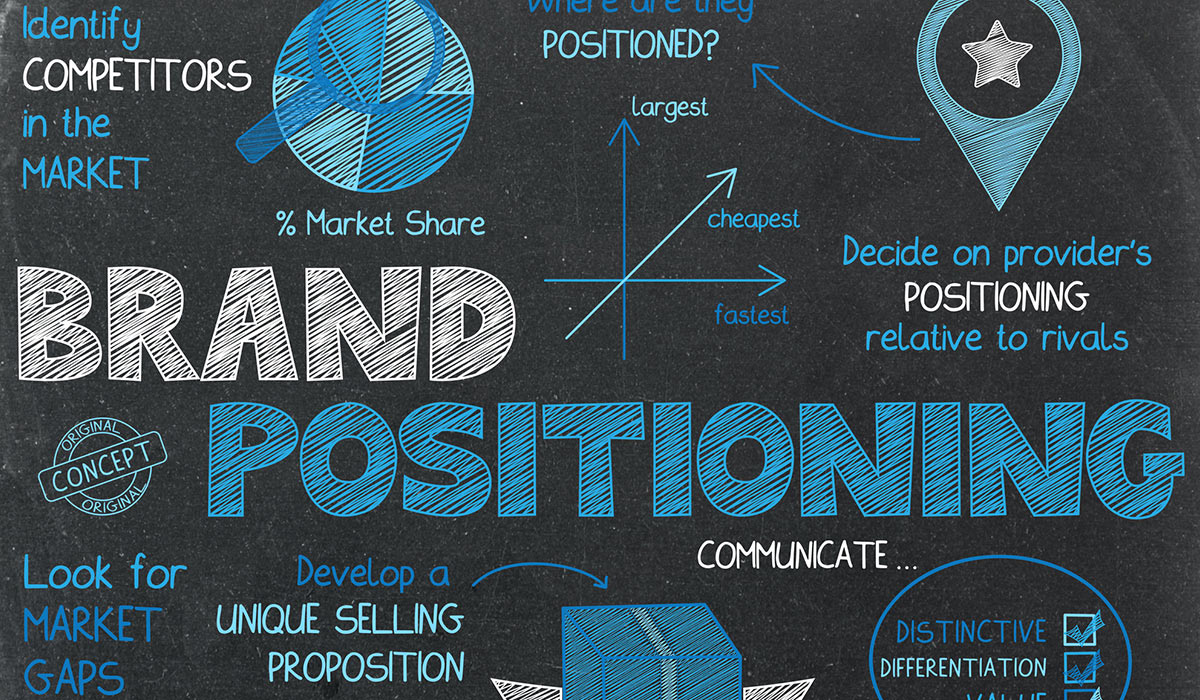

Positioning a new brand or product seems obvious by the time you get to it. You’ve defined your target market and their needs and figured out how your product uniquely meets those needs.

So, you create a positioning statement and “essence” (a single word or short phrase) that reflects your product or service differentiation, and that guides your marketing and sales messaging. And you are done, right? This is where many marketers forget a step and miss out on gaining customer’s attention.

Why 70% of Marketing Plans Omit a Key Step

In truth, the formula above works 30% of the time — when your product or service includes a game-changing, truly disruptive innovation. But 70% of the time, your new product is an incremental innovation.

Yonder Consulting defines incremental innovation as “small scale improvements to add or sustain value to existing products, services and processes.” Focusing your positioning on this “small scale improvement” will not be enough to cause your target market to notice your messaging. And it likely won’t lead prospects to become meaningfully engaged during sales conversations with your reps.

Here’s the Forgotten Step

Before you develop a positioning statement, most forget to determine the positioning word or phrase that your prospects already associate with the offering of your competitor(s). Why is this necessary?

In their classic book Positioning, The Battle for Your Mind, Ries and Trout explained that a prospect’s mind is like a parking lot. Each space represents a potential position that a brand can own.

If that space is already taken by a competitive brand, the prospect will reject or ignore anyone else trying to take the parking space. It’s biology – this is how our brains cope with the overwhelming number of stimuli in today’s world.

This is why your incrementally better new products, that are logically positioned around your small improvements, are often ignored. Your desired “brain parking spot” is already taken!

Fortunately, there are some very practical steps you can take to find your brain space. But first, look at how you can determine which spot your competitor(s) already own in your prospect’s brain.

Determining Your Competitor’s Already-Owned Position

A marketer’s life is certainly much easier with a research budget! As part of a customer needs study, you can ask respondents to share a word or phrase that they associate with key competitor’s offerings. However, if the product category is a routine purchase, research participants may not be able to do this.

In this case, ask them to share a word or phrase they associate with the competitor’s overall brand or organization. And while you are at it, ask them about your company too.

This may seem an odd thing to do, but they will answer the question if you give them the space and time to do so. And common themes will emerge, allowing you to develop a word or phrase your competitor already “owns.” You’ll also learn if your desired position is within reach, given what customers tell you about your own company.

If you don’t have a research budget, convene people within your company or in your partner network who can serve as proxies for customers. This will take a little time and effort, but the output will be valuable — and it will also inform future positioning projects.

3 Re-Positioning Strategies When a Competitor Owns the Space You Want

If your research uncovers that your desired positioning essence isn’t already owned by a competitor, great! But because so many products are introduced into mature markets, this will most often not be the case. You will have to work harder than you thought and re-position yourself and competitors.

Here’s 3 approaches you can take — the first two will likely not require a lot of re-strategizing, the last one might.

Values-Based Repositioning: Sometimes, competitors own a functional benefit sought in customers’ mind but have not created a values-oriented (aka emotion-based) positioning. This gives you an opportunity to develop a unique, values-focused position that is more motivating and makes competitors seem mundane.

Rather than re-think your entire strategy, you just move up the ladder to find the emotion behind the functional benefit you want to differentiate on. This can be accomplished by continually asking “why is functional benefit important?” until you land on an emotional reason.

Holiday Inn Express asked economic/price-focused buyers why paying a lower price was important until they discovered the emotional motivation. Price-buyers feel that they are too smart to overpay.

The hotel chain won over price-conscious business travelers by focusing on the more motivational “Stay Smart” position when competitors were focused on the functional message of “save money.” This case illustrates a valuable lesson for any B2Bs dealing with economic buyer: find the motivation behind their price sensitivity.

The Subdivision Repositioning Strategy: Customers easily remember the first person, brand or company to create a new category. For example, everyone remembers Charles Lindbergh as the first pilot to traverse the Atlantic via airplane. And everyone remembers Amelia Earhart’s name because she was the first woman to do so. But does anyone remember that Bert Hinkler did it — in between Lindbergh and Earhart?

The point is you might be able to pry attention from a competitor’s already-owned position by being the first to bring that same benefit to a subset or segment of your market. Let’s say you have a new B2B product that is marginally faster than a competitor.

But the competitor is already widely associated with being speedy. Instead of undertaking the almost impossible task of convincing the market that you are now the fastest, maybe you could subdivide the market to be first at something.

Could you add a few more efficiency characteristics to the offer (e.g., more convenient packaging, faster shipping, better/faster support, etc.) and position as “the first ______ designed specifically for companies focused on maximizing efficiencies?” The key to this strategy is leveraging any segmentation work that you’ve already done and dialing up your offer for your primary target(s).

The Opposite-Good Repositioning Strategy: When a competitor owns a powerful position in customer’s minds, you may be able to find an opposite position that is still beneficial to the customer. For example, the good opposite of “the biggest” might be “fast/nimble”; the good opposite of” the fastest” could be “highest quality”, and so on.

IBM in the 1960’s to 1980’s effective painted almost all innovative competitors as “risky” by owning the opposite position of “safest choice.” It’s unofficial position of “no one ever got fired for buying IBM” was massively successful.

The only problem with the opposite-good strategy is that you may have to re-work your plan and build your value proposition around different benefits. That is often not possible because of long R&D cycles in many B2B industries.

This speaks to the importance of thinking about positioning much earlier in the product development cycle than is common today. If it’s too late to make changes, you can revert to one of the first two methods highlighted above.

Trying to dislodge a competitor’s already-owned positioning is almost impossible because it goes against the coping mechanisms of the human brain. Include the forgotten step of discovering the positioning essence early in your strategy development. Then utilize a re-positioning strategy to truly capture the attention of your target market and diminish the perceptual hold competitor’s may have on your prospects. You’ll see that its more than worth it, even if it requires you to re-work parts of your plan.

Tom Spitale

Tom Spitale Mary Abbazia

Mary Abbazia