How does your B2B organization measure the uniqueness of your products and services as compared to your competitors? Waiting for sales results or market share data to assess your level of differentiation is a mistake: you are relying on too-little, too-late lagging indicators.

If you want to be a proactive market leader, you need a leading indicator that measures the most important thing in business: are you providing unique value to your target market customers?

What you need to focus on is a powerful measure called The Differentiation Index (TDI). TDI is a leading indicator of your product or service’s unique value as seen through the eyes of your customer, and enables three powerful outcomes:

- It helps executives decipher strategic plans and figure out which new and existing products are worthy of more investment

- It helps marketing leaders proactively manage their portfolios and direct their attention towards underperforming products before they become a problem

- It helps product and service managers devise strategies that matter to customers and separate offerings from those of competitors

Why Measuring Competitive Differentiation Is Important

There can be no more important metric. This is due to a business fact that never has and never will change: you need customers.

How does your business attract customers? By providing what they think is the most unique value available to them.

Yes, sometimes customers choose lower-value/lower-price products. We consider successful lower-end products like these to be differentiated too — in addition to market-leading mid-line, and premium offerings. If a product is succeeding, it is differentiated.

Strangely, in a business world that is obsessed with early-warning metrics, there’s no widely-used leading indicator that tells us how unique our offering is now or how it will fare in the near future. Companies can foresee upcoming trouble in overall demand levels, anticipate supply-chain hiccups, and brace for customer service troubles.

Why is it that they don’t measure their ability to attract customers — the most important root cause driving these “symptoms” known as “demand deficits” and “service spikes”? Perhaps because they aren’t aware of TDI.

How To Measure Your Differentiation Index (TDI)

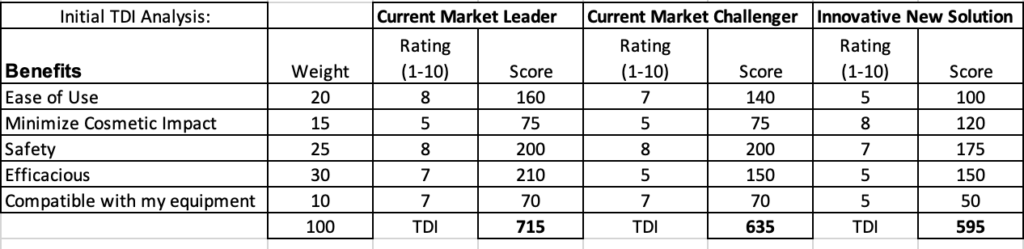

Impact Planning Group has taught clients the following straightforward method for measuring differentiation via TDI for decades. As a result, these companies have reported an improved ability to focus their product development, communication and pricing in ways that truly matter to customers. Here are the basic instructions, with an example below for reference:

- For any given market, pick a key stakeholder and list the top 5 tangible, rational benefits that they are seeking when evaluating solutions like yours — regardless of whether your solution delivers on these benefits or not. Don’t stack the deck in your favor! Spread 100 points across the 5 benefits in order of their relative importance to target customers.

NOTE: If you already feel overwhelmed because you don’t have this data and no research budget, you can approximate this information using an internal group of customer-facing personnel. Don’t give up here! If you do, you are unwisely consenting to operate your business without a hypothesis of top customer needs. In the immortal words of a former Impact colleague describing the need to hypothesize, “bad breath is better than no breath!”

- On a 1-10 scale, rate the overall perception customers have of your company and your competitors’ abilities to deliver on each benefit. (Again, use your best proxy resource to get these ratings if you can’t ask customers directly.)

- Multiply the perceptual rating by the benefit weight for each of the 5 benefits to create a score for you and each competitor.

The resulting score models how customers make decisions. It shows your product or service’s differentiation (or lack of) in the market.

In the case above, our client — whose score is in the last column with a TDI of 595 — was struggling in the early stages of launching a new medical device. The existing standard-of-care market leader — with a TDI of 715 — was very popular, and few hospitals were switching.

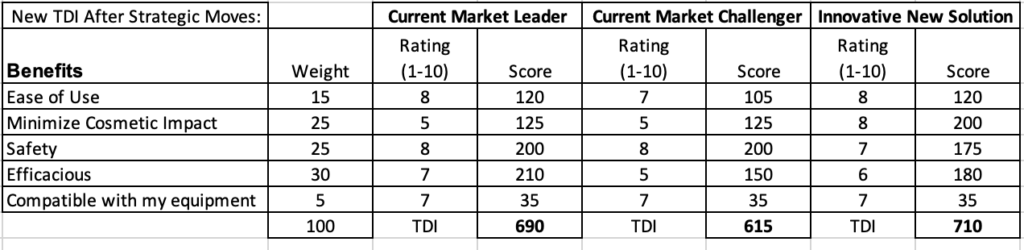

The TDI analysis not only explained our client’s market share woes; it also pointed out the path forward. By investing in improving ease of use (which also helped improve compatibility ratings), and focusing on hospital/doctor segments who valued cosmetic impact more than many, our client’s TDI score massively increased. Market share gains followed.

Why a Flawed Differentiation Index Is Better Than None At All

Maybe you are starting to see the value of TDI, but worry that you are not close to having accurate data to populate it. Are you thinking that if it is built on a foundation of faulty assumptions, hopes, and fears rather than reality, it will be worthless? Well, even a flawed TDI can be reality-checked and provide value to your firm.

For example, if your TDI score is high and your market share is not, you are suffering from the delusion of over-confidence. Something went wrong in your initial hypothesis. You either got the benefits wrong or over-inflated your perceptual score. You need to take what we call “the cold shower of reality” and face some difficult truths.

But you see, in the process of developing and reviewing your initial TDI hypothesis, you now have a more specific view of what you need to get the analysis right. Did you get the benefits wrong or the customer perceptions wrong, or both? Either way, you are on the path to better understanding the customers that are the lifeblood of your business.

And once you fix your TDI score to more closely match your market share reality, you now have a more granular view than ever of what needs to be done to differentiate and succeed. This empowers executives, marketing leaders, and product managers in a whole new way.

How Executives, Marketing Leaders and Product Managers Are Empowered by TDI

Executives can use TDI and its components to more realistically assess product plans and make investment decisions. You can ask more specific questions about customer needs and perceptions, and judge the relevance and wisdom of investments in the products and services you are reviewing.

Marketing Leaders can use TDI to easily see where there is a disconnect between company financial expectations and customer perceptions of value. They can intervene and direct resources to further differentiate these product lines before the situation erodes further.

Product managers can ensure that their time, energy and resources are spent improving capabilities that truly matter to customers.

B2B companies spend enormous amounts of time trying to do all of these things. TDI gives them a single metric and analysis so they can get straight to effective strategies and execution.

TDI Tells You If You Can Get and Grow Customers Better Than Competitors

Those of you who are fans of another marketing-oriented metric — Net Promoter Score (NPS) — might have noticed the similarity of this article’s title to the original Harvard Business Review article introducing that measure. This isn’t an accident. NPS set off a metric revolution starting back in 2003 and TDI may do the same.

NPS tells you how likely customers, who you are already interacting with, are to stay loyal and recommend you to others. We call NPS a “keep” metric — it will predict customer loyalty.

But before you can keep a customer, you have to acquire (“get”) them. And if you are successfully getting and keeping customers, the quickest path to growth is selling more to satisfied, loyal customers.

TDI as a “get” and “grow” metric. It’s even more essential than NPS because it will tell you how likely your offers are to attract significant amounts of business from your target markets. You have to have a customer before you can get to work on the important business of keeping them.

Use TDI before your competitors find out about it, and you will be measuring something — differentiation — that they aren’t. And since what gets measured gets managed, you will be better than competitors at managing the most critical process in business — getting and growing customers.

Tom Spitale

Tom Spitale